41 treasury bill coupon rate

U.S. Treasury Blocks Over $1 Billion in Suleiman Kerimov Trust Enforcement investigation unearthed oligarch's use of a network of relatives, advisers, and opaque legal entities to invest in the United States WASHINGTON - Today, the U.S. Department of the Treasury's Office of Foreign Assets Control (OFAC) announced it has issued a Notification of Blocked Property to Heritage Trust, a Delaware-based trust in which OFAC-designated Russian oligarch ... Transcript of Press Conference from Secretary of the Treasury Janet L ... As Prepared for Delivery Thank you for being here. This has been a very productive week and I'd like to thank the IMF and World Bank - as well as my counterparts in Germany and Indonesia at the G7 and G20 respectively - for their leadership this week. A significant amount of our focus this week has been on Russia's reckless, devastating, and illegal war against Ukraine, and our allies ...

Individual - Treasury Notes: Rates & Terms Treasury Notes: Rates & Terms Notes are issued in terms of 2, 3, 5, 7, and 10 years, and are offered in multiples of $100. Price and Interest The price and interest rate of a Note are determined at auction. The price may be greater than, less than, or equal to the Note's par amount. (See rates in recent auctions .)

Treasury bill coupon rate

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ... Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction. Coupon Equivalent Rate (CER) Definition - Investopedia Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96. Compared with a bond paying an 8% annual coupon we'd choose the zero-coupon bond...

Treasury bill coupon rate. US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity. Individual - Treasury Bills: Rates & Terms Treasury bills are offered in multiples of $100 and in terms ranging from a few days to 52 weeks. Price and Interest Bills are typically sold at a discount from the par amount (par amount is also called face value). The price of a bill is determined at auction. Using a single $100 investment as an example, a $100 bill may be auctioned for $98. A guide to US Treasuries Treasuries are issued in six main structures. Usually, the longer the maturity, the higher the interest rate, or coupon.. Treasury bills (T-bills): T-bills have the shortest maturities at four, eight, 13, 26, and 52 weeks. T-bills are typically issued at a discount to par (or face) value, with interest as well as principal paid at maturity. Selected Treasury Bill Yields - Bank of Canada Treasury bills. Treasury bill yields presented are an average of sample secondary market yields taken throughout the business day. Data available as: CSV, JSON and XML. Series. 2022‑05‑25. 2022‑06‑01. 2022‑06‑08. 2022‑06‑15. 2022‑06‑22.

What are coupons in treasury bills/bonds? - Quora Treasury bonds and bills have a coupon rate. The coupon rate is the interest rate on the par value of the bond that the bondholder receives annually. Since these securities almost never sell at par, the coupon rate almost never corresponds to the return the investor will receive by Continue Reading Bill Terrell Investing for over 25 years. Advantages and Risks of Zero Coupon Treasury Bonds The Vanguard Extended Duration Treasury ETF ( EDV) went up more than 55% in 2008 because of Fed interest rate cuts during the financial crisis. 5 The PIMCO 25+ Year Zero Coupon U.S. Treasury Index... Coupon Interest and Yield for eTBs - australiangovernmentbonds The Coupon Interest Rate on a Treasury Bond is set when the bond is first issued by the Australian Government, and remains fixed for the life of the bond. For example, a Treasury Bond with a 5% Coupon Interest Rate will pay investors $5 a year per $100 Face Value amount in instalments of $2.50 every six months. Interest Rates - U.S. Department of the Treasury APY = 1.081600 -1 APY = 0.081600 And, expressed as a percent: APY = 8.16% Are the CMT rates used to set Adjustable Rate Mortgage (ARM) rates? Treasury does not make the determination as to which, if any, CMT rate index is used to set an ARM rate. ARM rates are set by the financial institution that made or holds the mortgage.

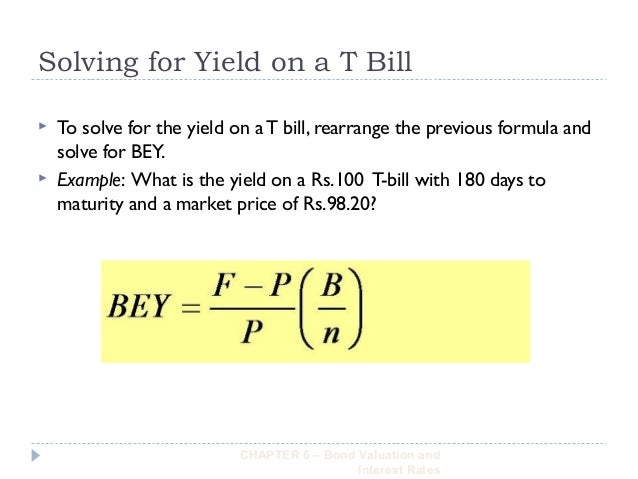

Treasury Bills (T-Bills) Definition - Investopedia As stated earlier, the Treasury Department auctions new T-bills throughout the year. On March 28, 2019, the Treasury issued a 52-week T-bill at a discounted price of $97.613778 to a $100 face... Individual - Treasury Bonds: Rates & Terms Treasury Bonds: Rates & Terms Treasury bonds are issued in terms of 20 years and 30 years and are offered in multiples of $100. Price and Interest The price and interest rate of a bond are determined at auction. The price may be greater than, less than, or equal to the bond's par amount (or face value). (See rates in recent auctions .) India Treasury Bills (over 31 days) | Moody's Analytics Treasury bills are zero coupon securities and pay no interest. They are issued at a discount and redeemed at the face value at maturity. For example, a 91 day Treasury bill of Rs.100/- (face value) may be issued at say Rs. 98.20, that is, at a discount of say, Rs.1.80 and would be redeemed at the face value of Rs.100/-. Resource Center | U.S. Department of the Treasury 26 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 52 WEEKS BANK DISCOUNT. COUPON EQUIVALENT. 1 Mo. 2 Mo. 3 Mo. 20 Yr. 30 Yr.

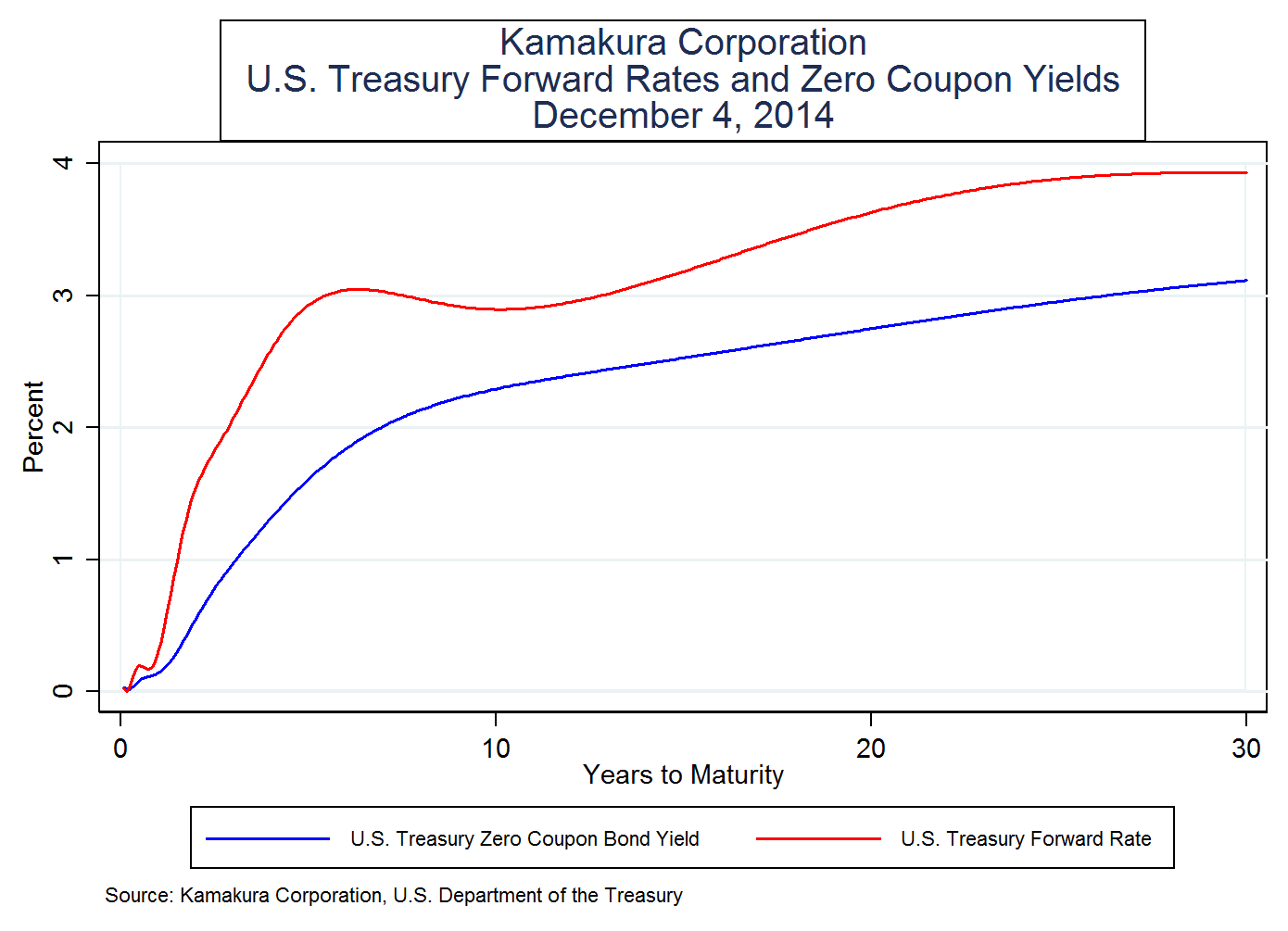

Treasury Coupon Issues | U.S. Department of the Treasury Nominal TNC Data TNC Treasury Yield Curve Spot Rates, Monthly Average: 1976-1977TNC Treasury Yield Curve Spot Rates, Monthly Average: 1978-1982TNC Treasury Yield Curve Spot Rates, Monthly Average: 1983-1987TNC Treasury Yield Curve Spot Rates, Monthly Average: 1988-1992TNC Treasury Yield Curve Spot Rates, Monthly Average: 1993-1997TNC Treasury Yield Curve Spot Rates, Monthly Average: 1998 ...

United States Rates & Bonds - Bloomberg.com Name Coupon Price Yield 1 Month 1 Year Time (EDT) GTII5:GOV . 5 Year

How To Read A T-Bill Quote - Investopedia 3*100/360=$0.83 $10,000-$0.83=$9,999.17 In this example, the seller is willing to accept $9,999.17 for a bill that will be redeemed for $10,000 in 100 days. Change The change shows the difference...

Understanding Coupon Rate and Yield to Maturity of Bonds The frequency of payment depends on the type of fixed income security. In the above example, a Retail Treasury Bill (RTB) pays coupons quarterly. To translate this to quarterly payment, first, multiply the coupon rate net of 20% final withholding taxes by the face value (1.900% x 1,000,000). Then, divide the resulting annual amount by 4.

Individual - Treasury Bills In Depth Treasury bills, or T-bills, are typically issued at a discount from the par amount (also called face value). For example, if you buy a $1,000 bill at a price per $100 of $99.986111, then you would pay $999.86 ($1,000 x .99986111 = $999.86111).* When the bill matures, you would be paid its face value, $1,000.

Should You Buy Treasuries? With interest rates rising, government bonds have become a lot more attractive for investors searching for a return on cash. The current rate on a U.S. two year Treasury is 3.05%.¹ In comparison ...

Interest Rate Statistics | U.S. Department of the Treasury Daily Treasury Bill Rates These rates are indicative closing market bid quotations on the most recently auctioned Treasury Bills in the over-the-counter market as obtained by the Federal Reserve Bank of New York at approximately 3:30 PM each business day. View the Daily Treasury Bill Rates Daily Treasury Long-Term Rates and Extrapolation Factors

How Are Treasury Bill Interest Rates Determined? The interest rate comes from the spread between the discounted purchase price and the face value redemption price. 3 For example, suppose an investor purchases a 52-week T-bill with a face value...

PDF Price, Yield and Rate Calculations for a Treasury Bill Calculate the ... In order to calculate the Coupon Equivalent Yield on a Treasury Bill you must first solve for the intermediate variables in the equation. In this formula they are addressed as: a, b, and c. 364 0.25 (4) a = Calculate Coupon Equivalent Yield For bills of not more than one half-year to maturity For bills of more than one half-year to maturity i ...

Understanding Treasury Bond Interest Rates - Bankrate.com What do Treasury bonds pay? Imagine a 30-year U.S. Treasury Bond is paying around a 1.25 percent coupon rate. That means the bond will pay $12.50 per year for every $1,000 in face value (par value ...

Treasury Bills (T-Bills) - Meaning, Examples, Calculations For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Coupon Equivalent Rate (CER) Definition - Investopedia Its coupon equivalent rate would be 8.08%, or ( ($10,000 - $9,800) / ($9,800)) * (360 / 91), which is 0.0204 * 3.96. Compared with a bond paying an 8% annual coupon we'd choose the zero-coupon bond...

Treasury Bills - Guide to Understanding How T-Bills Work In this case, the discount rate is 5% of the face value. Get T-Bill rates directly from the US Treasury website. How to Purchase Treasury Bills Treasury bills can be purchased in the following three ways: 1. Non-competitive bid In a non-competitive bid, the investor agrees to accept the discount rate determined at auction.

U.S. Treasury Confirms I Bonds Will Pay A 9.62% Interest Rate With inflation increasing this year to multi-decade highs, I Bonds bought from May until Monday, October 31, will pay an annualized interest rate of 9.62%. Keep in mind that the 9.62% rate is an ...

Post a Comment for "41 treasury bill coupon rate"