38 zero coupon bond yield calculation

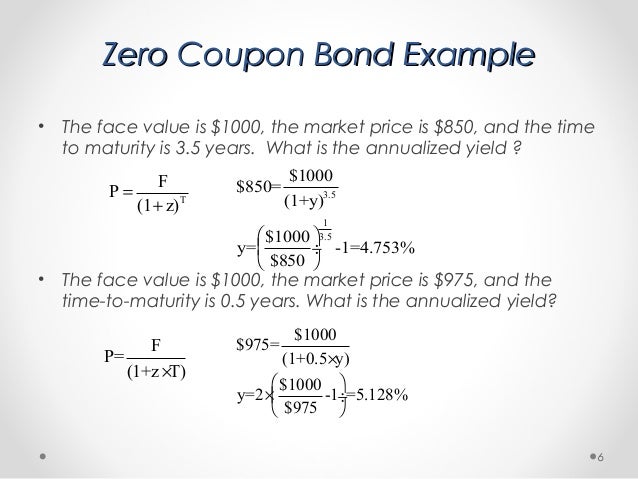

Zero Coupon Bond Effective Yield Calculator Zero Coupon Bond Effective Yield Solution STEP 0: Pre-Calculation Summary Formula Used Zero Coupon Bond Effective Yield = (Face Value/Present Value)^ (1/Number of Periods)-1 ZCB Yield = (F/PV)^ (1/n)-1 This formula uses 3 Variables Variables Used Face Value - Face value is the nominal value or dollar value of a security stated by the issuer. Bond Yield Formula | Step by Step Calculation & Examples Step 2: Calculation of bond yield Bond Yield = Annual Coupon Payment/Bond Price =$78/$1600 Bond Yield will be - =0.04875 we have considered in percentages by multiplying with 100's =0.048*100 Bond Yield =4.875% Here we have to saw that increase in bond prices results in the decrease in bond yield. Example #2

Zero Coupon Bond Yield Calculator - YTM of a discount bond This calculator can be used to calculate the effective annual yield or yield to maturity (YTM) of investment in such bond when the bond is held till maturity. Purchase Price of Bond Face Value / Maturity Value of Bond Bond Purchase Date (DD/MM/YYYY) Bond Maturity Date (DD/MM/YYYY) % p.a.

Zero coupon bond yield calculation

Zero Coupon Bond Yield Calculator - Find Formula, Example & more Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the bond will provide the investor with a yield of 7.39% What is the use of Zero Coupon Bond Yield Calculator? Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero coupon bond yield calculation. Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600. Par Value: $1000. Years to Maturity: 3. Annual Coupon Rate: 0%. Coupon Frequency: 0x a Year. Price =. (Present Value / Face Value) ^ (1/n) - 1 =. Zero Coupon Bond Effective Yield Calculator | StableBread Perpetuity Yield (PY), Present Value of Perpetuity (PVP), and Perpetuity Payment (PP) Calculator Present Value (PV) and Future Value (FV) Number of Periods Calculator Present Value (PV) Calculator Present Value of Preferred Stock (PVPS) Calculator Profitability Index Calculator Dividends Dividend Discount Model (DDM) Calculator Zero-Coupon Bond - Definition, How It Works, Formula To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or interest rate; and. n is the number of years until maturity. Note that the formula above assumes that the interest rate is compounded annually. Coupon Equivalent Rate (CER) Definition - Investopedia Coupon Equivalent Rate - CER: A alternative calculation of coupon rate used to compare zero-coupon and coupon fixed-income securities. Formula:

Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond's future coupon payments. In order to calculate YTM, we need the bond's current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Where: Bond ... Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter Now the thing to understand is how this yield is calculated, so for that, and there is a particular formula in terms of economics that helps us to calculate that yield. The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods How do I Calculate Zero Coupon Bond Yield? (with picture) Jun 01, 2022 · The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. Value and Yield of a Zero-Coupon Bond | Formula & Example The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period

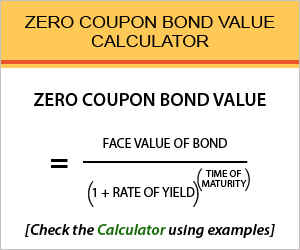

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date. Zero Coupon Bond Yield - Formula (with Calculator) The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o... Zero Coupon Bond Value Calculator - Top 10 Stock Broker A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Bond Yield Calculator.

Zero-Coupon Bond Calculation - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate . n = years until maturity ...

Zero Coupon Bond Calculator Zero Coupon Bond Formula The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t where ZCBV is the zero-coupon bond value F is the face value of the bond r is the yield/rate t is the time to maturity Zero Coupon Bond Definition

Zero Coupon Bond Yield: Formula, Considerations, and Calculation Mar 09, 2022 · The formula for calculating the yield to maturity on a zero-coupon bond is: Yield To Maturity= (Face Value/Current Bond Price)^ (1/Years To Maturity)−1 Zero-Coupon Bond YTM Example Consider a...

Zero-Coupon Bond: Formula and Excel Calculator To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) – 1 Zero-Coupon Bond Risks

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19. The difference between the current price of the bond, i.e., $463.19, and its Face Value, i.e., $1000, is the amount of compound interest

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero Coupon Bond Yield Calculator - Find Formula, Example & more Zero Coupon Bond Effective Yield = ( (Face Value of Bond / Present Value of Bond) ^ (1 / Period)) - 1 The process of solution we need to use is: Zero Coupon Bond Effective Yield = ( (1000 / 700) ^ (1 / 5)) - 1 Here, the bond will provide the investor with a yield of 7.39% What is the use of Zero Coupon Bond Yield Calculator?

:max_bytes(150000):strip_icc()/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "38 zero coupon bond yield calculation"